Covered Interest Rate Parity Example

18 However even when someone is insured mental health services are often not covered at the same level as other kinds of care. In 2015 about 6 million rural residents lacked health insurance.

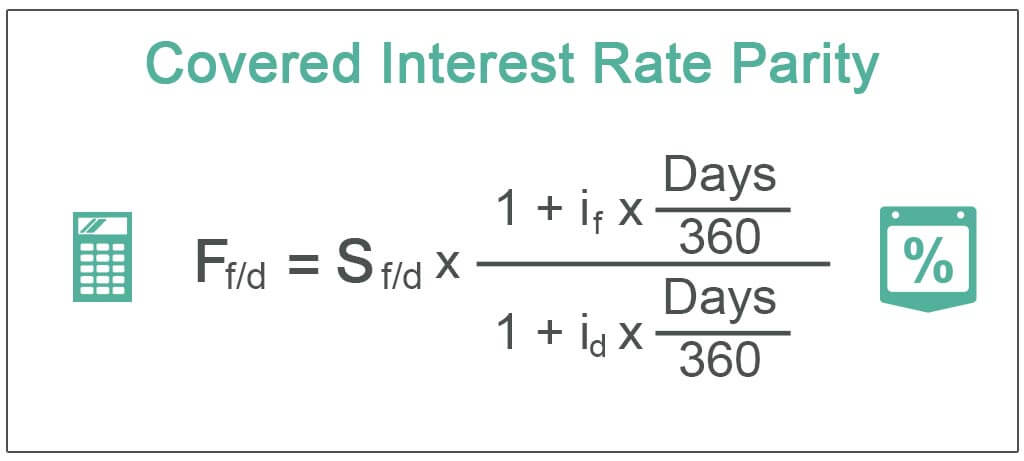

Covered Interest Rate Parity Cirp Definition Formula Example

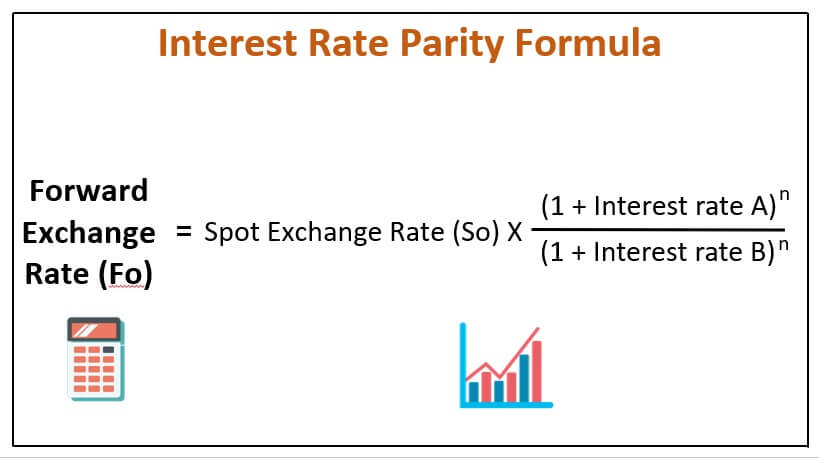

The fact that this condition does not always hold allows for potential opportunities to earn riskless profits from covered interest arbitrageTwo assumptions central to interest rate parity are capital mobility and.

. Difference in exchange rates. Using forward contracts enables arbitrageurs such as individual investors or banks to make use of the forward premium or discount to earn a riskless profit. According to covered interest rate parity the difference between interest.

So 300 at a rate of 13 will buy 230. The difference between the spot and forward rates is known as swap points and amounts to. Hence it involves the use of an estimation of the expected future rate and not the actual forward rate.

Interest rate parity is a no-arbitrage condition representing an equilibrium state under which investors interest rates available on bank deposits in two countries. Covered interest rate parity CIRP is a theoretical financial condition that defines the relationship between interest rates and the spot and forward currency rates of two countries. The Agreement which was in force between 1944 and 1971.

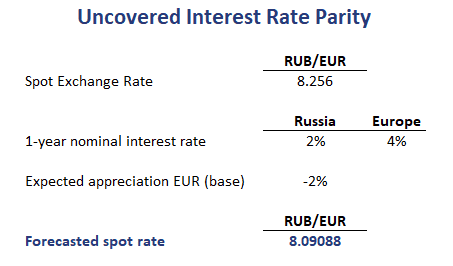

One-year rate of 025. However uncovered interest rate parity takes into account expected rates which basically implies forecasting future interest rates. For example the rate for GBPUSD represents what 1 pound is worth in dollars.

Covered interest arbitrage is an arbitrage trading strategy whereby an investor capitalizes on the interest rate differential between two countries by using a forward contract to cover eliminate exposure to exchange rate risk. The Bretton Woods Agreement signed by the main industrial economies after the Second World War established a set of rules to regulate the international monetary system with the intention of assuring monetary stability. It establishes the fact that there is no opportunity for arbitrage using forward contracts which are often used to make loose profits by exploiting the difference in interest rates.

19 The 2008 Mental Health Parity and. Now let us take another example. Then if the exchange rate climbs you would sell your pounds back and make a.

17 Providing insurance via employer benefits or public programs can improve access to health care by making it more affordable. Cristina Terra in Principles of International Finance and Open Economy Macroeconomics 2015. The forward rate is based on a Canadian one-year interest rate of 068 and a US.

Covered interest rate parity refers to a theoretical condition in which the relationship between interest rates and the spot and forward currency values of. So if you have reason to believe the pound will increase in value versus the US dollar you would purchase say 500 pounds with US dollars. Break Even Analysis Formula- Example 5 A factory wants to study Break Even point and want to generate a profit of 500000 the total fixed cost of a product is 100000 the variable cost per unit 200 sales price per unit is 300.

Interest Rate Parity Formula With Calculator

Interest Rate Parity Definition Formula How To Calculate

Uncovered Interest Rate Parity Breaking Down Finance

0 Response to "Covered Interest Rate Parity Example"

Post a Comment